In the dynamic landscape of the Progressive Insurance in Lake Charles industry, finding the right coverage to safeguard our valuable assets and provide peace of mind is paramount. One company that has made significant strides in offering innovative insurance solutions is Progressive Insurance. Whether you’re a resident of the vibrant Lake Charles community or a newcomer to its scenic shores, securing the appropriate insurance coverage is a crucial step towards protecting your investments, be it your automobile, home, or business. In this blog post, we delve into the world of Progressive Insurance in Lake Charles, uncovering its distinctive features, customer-centric approach, and the array of benefits it brings to the local residents. Join us as we explore how Progressive Insurance is reshaping the insurance landscape in Lake Charles, redefining the way we perceive and attain comprehensive insurance coverage.

Progressive Insurance has garnered a reputation that stands out amidst the insurance giants, thanks to its commitment to offering policies that cater to the unique needs of its customers. Nestled in the heart of Lake Charles, a city known for its rich culture, diverse community, and picturesque landscapes, Progressive Insurance understands the significance of tailoring insurance coverage to match the lifestyle and demands of the local population. With a myriad of options available, Progressive Insurance ensures that the residents of Lake Charles can choose from a spectrum of policies, enabling them to select coverage that aligns seamlessly with their individual requirements.

Why is Progressive insurance better?

“Better” is subjective and can vary depending on individual needs and preferences. However, there are several aspects of Progressive Insurance that many customers find appealing and advantageous:

Customizable Policies:

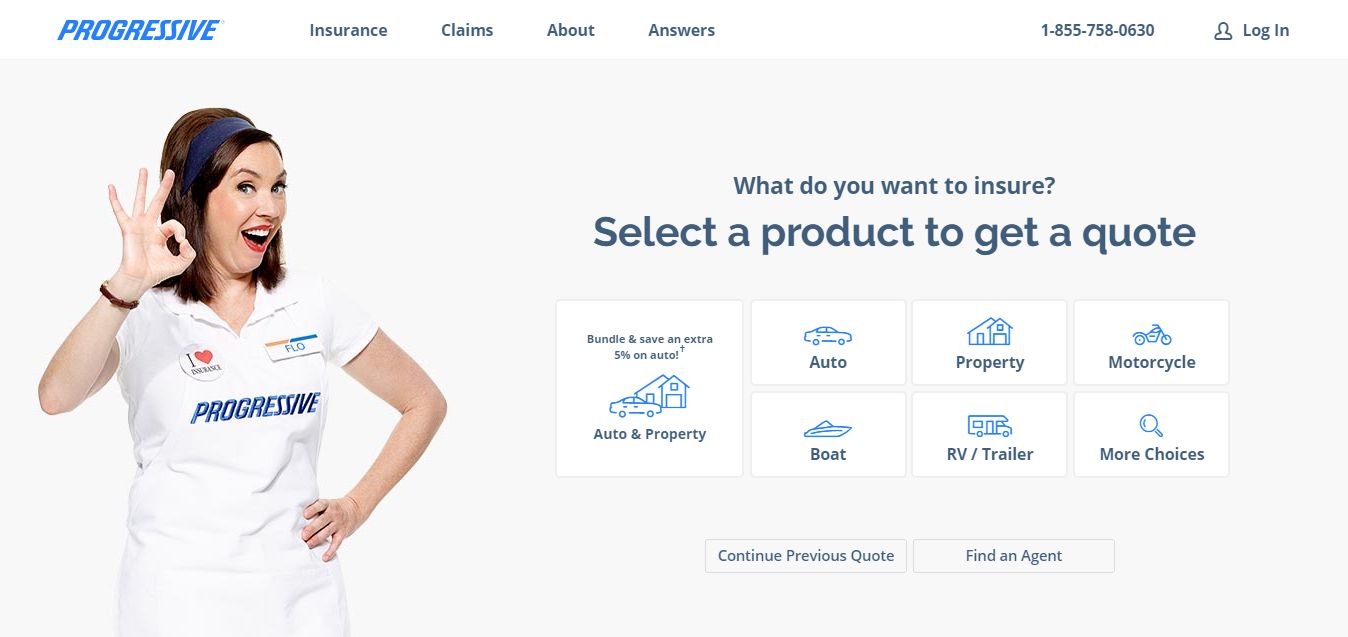

Progressive offers a wide range of insurance products, allowing customers to tailor their coverage to their specific needs. Whether you’re looking for auto insurance, home insurance, or other types of coverage, Progressive provides various options to choose from.

Usage-Based Programs:

Progressive’s Snapshot program is an example of their innovative approach to insurance. It monitors driving habits through a telematics device or mobile app, potentially rewarding safe drivers with discounts on their premiums.

User-Friendly Online Tools:

Progressive has invested in user-friendly online tools and a mobile app that make it easy for policyholders to manage their policies, make payments, and file claims online. This convenience can save customers time and effort.

Bundling Options:

Progressive allows customers to bundle different insurance policies, such as auto and home insurance, which can often lead to cost savings.

Competitive Rates:

Progressive is known for offering competitive rates in the insurance market. Their advertising often emphasizes their commitment to providing affordable coverage options.

Financial Strength:

Progressive has a strong financial rating, which can be reassuring for customers concerned about the company’s ability to pay out claims when needed.

Customer Service:

While customer service experiences can vary, many customers appreciate Progressive’s efforts to provide responsive and helpful customer support.

Transparency:

Progressive is known for its clear and straightforward policy documentation, making it easier for customers to understand their coverage and what is included in their policy.

Variety of Discounts:

Progressive offers a range of discounts for factors like safe driving, bundling policies, paying in full, and more, potentially helping customers save on their premiums.

It’s important to note that what makes an insurance company “better” can depend on factors like coverage needs, budget, location, and personal preferences. Before choosing an insurance provider, it’s recommended to thoroughly research your options, obtain quotes, and consider what features are most important to you in an insurance policy. Additionally, reading customer reviews and seeking recommendations from friends or family can provide insights into other people’s experiences with Progressive or any other insurance company you’re considering.

Who is better Progressive or Safeco?

Determining whether Progressive or Safeco is better for you depends on various factors such as your specific insurance needs, budget, location, and personal preferences. Both Progressive and Safeco are established insurance companies, each with its own strengths and offerings. Let’s take a closer look at each company.

Progressive:

1) Strengths

Progressive is known for its innovative approach to insurance, user-friendly online tools, and competitive rates. They offer a variety of insurance products, including auto, home, renters, and more. Their Snapshot program rewards safe driving habits with potential discounts.

Unique Features: Progressive’s online tools and mobile app are often praised for their ease of use. Their wide range of discounts and customizable coverage options are also appealing to many customers.

Safeco:

2) Strengths

Safeco is known for its personalized service and local agents. They offer a variety of insurance products as well, including auto, home, renters, and more. Safeco often emphasizes its commitment to building relationships with customers through local agents.

Unique Features: Safeco’s local agents can provide a personalized touch, helping customers find coverage that aligns with their specific needs. They also offer a variety of discounts and optional coverages.

To determine which is better for you, consider these steps:

Assess Your Needs: Determine the types of insurance coverage you need, such as auto, home, or renters insurance, and any specific coverage requirements you have.

Obtain Quotes:

Get quotes from both Progressive and Safeco to compare their rates for the coverage you need. Make sure the quotes include the same coverage limits and options for an accurate comparison.

Research Reputation:

Look into the reputation and financial strength of both companies. Check online reviews and ratings from reputable sources to understand customer experiences.

Consider Customer Service:

If personalized service is important to you, Safeco’s local agents might be a favorable aspect. Evaluate how each company handles customer service inquiries and claims.

Ultimately, the “better” choice will depend on your individual circumstances. Take the time to thoroughly research and compare both companies to make an informed decision that aligns with your insurance needs and preferences. It’s also advisable to consult with insurance professionals or agents who can provide guidance based on your specific situation.